Should you buy Flood and Earthquake Insurance?

Most people will tell you that both flood and earthquake disasters are extremely rare today. Even if this is true, the most recent disasters that have occurred in both the United States and beyond have been extremely devastating both emotionally and financially. If you didn’t have insurance and your house ended up in the middle of a natural disaster, how would you pay for it? Do you think that you would have enough money to potentially rebuild your entire house from scratch? Will homeowners insurance alone be enough to cover you? These are questions that everyone should be able to answer accordingly.

Most people will tell you that both flood and earthquake disasters are extremely rare today. Even if this is true, the most recent disasters that have occurred in both the United States and beyond have been extremely devastating both emotionally and financially. If you didn’t have insurance and your house ended up in the middle of a natural disaster, how would you pay for it? Do you think that you would have enough money to potentially rebuild your entire house from scratch? Will homeowners insurance alone be enough to cover you? These are questions that everyone should be able to answer accordingly.

To answer one of the questions asked above, most homeowners insurance will not cover earthquake or flood damage. If a natural disaster occurs in a large enough area, assistance is normally provided through loans or grants by the government. This area will then be classified as a disaster area by the Federal Emergency Management Agency (FEMA). If this type of scenario concerns you at all, the first thing that should be done is to go over your current insurance plan with your provider to find out what is and what isn’t covered. If you live in an area that is prone to either floods or earthquakes and your current plan doesn’t cover this type of damage, it may be time to reconsider.

Earthquake Insurance

Most homeowners’ policies will have very limited coverage in terms of earthquake damage. While loss may in fact be covered because of explosion, fire, theft or glass breakage, damage from the earthquake itself will not be covered. Because of this, if you live in an area where earthquakes happen routinely, it is best that you consider purchasing earthquake insurance.

In most cases, both your possessions and house will be covered under earthquake insurance. This type of policy may also cover additional living expenses, as well as costs used to help protect your home accordingly after an earthquake has occurred. Depending on your location and the scope of the coverage, costs for insurance can vary accordingly. This type of coverage can be purchased along with your existing homeowner’s insurance or as a separate policy.

When determining whether or not you should purchase earthquake insurance, you need to consider factors like the likelihood that an earthquake would cause excessive damage to your home, whether you could afford to replace your house, whether your house is strong enough to sustain an earthquake, and how frequently earthquakes occur in your neighborhood. Be sure that the policy purchased covers both personal possessions and rebuilding costs.

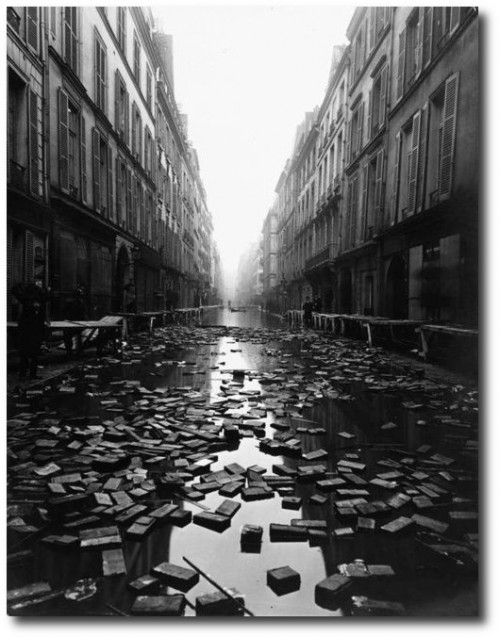

Flood Insurance

As far as flood insurance goes, you may consider purchasing this even if you don’t live in a location that is prone to flooding. Natural disasters aren’t the only event that can cause flooding. Things like storms, snow, and hurricanes can cause massive amounts of flooding as well. In fact, the National Flood Insurance Program (NFIP) themselves claim that around “20% of all flood insurance claims come from areas that are at low to moderate risk for floods.”

It is important to keep in mind that unlike earthquake insurance, flood insurance cannot be tacked onto your current homeowner insurance. Instead, it must be purchased as a separate policy.

Should you purchase flood insurance? This type of plan will provide coverage for both your home and all of its possessions. Up to $100,000 can be purchased to cover your possessions and up to $250,000 can be purchased to cover your home. Keep in mind that this type of insurance does not cover every type of damage unless directly involved by a flood. Separate incidents like sewer backups or sump pump failure are not covered unless caused by a flood.